Debt consolidation and credit counselling are probably the best options a person can have in order to get out of his/her debt. However, people often end confusing both these terms. When struggling with debt, you need to calculate every possible calculation and determine every possible scenario so as to decide which debt relief option is the good for you. Once you arrive at a decision, you will certainly get monetary relief.

Why Choose Debt Consolidation?

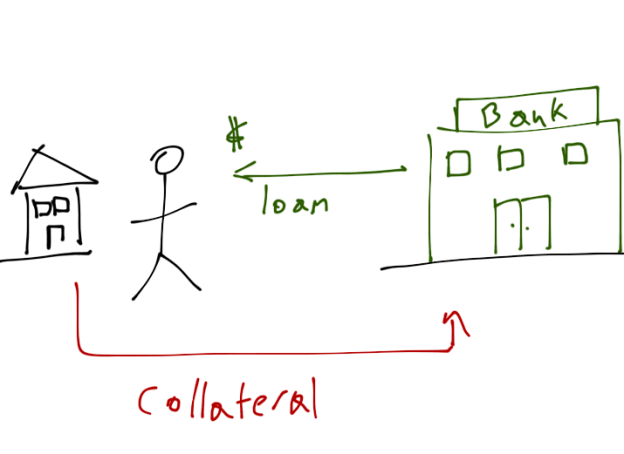

Generally, debt consolidation is considered a very broad term. It works by combining all your debts into one but a manageable payment. People who have little or no understanding of the concept of debt relief end up thinking that debt consolidation is actually a big loan to pay other loans and therefore immediately jump on a conclusion. Although this is right but there are other options too which can help you equally well, like credit counselling.

Credit counselling is just a form of debt consolidation because it also follows the idea of consolidating of payments into one. One can get him/herself enrolled with a credit counselling program with a mortgage company. You will be required to send your payments to this company who will further distribute them for you.

What’s noteworthy is that both these debt relief options require a steady income in the absence of which debt consolidation loans are not possible. This is because without an income, you will not be able to pay the lender from which you have taken the consolidation loan. For credit counselling too, no counsellor will come forward to assist you. Without a fixed salary, all you can get is advice, but even that won’t help if you have no means to repay your loan.

Credit Counselling and Debt Consolidation

Usually, credit counselling companies are affiliated with creditors. They associate with these non-profit agencies so as to minimize the losses by giving free help and advice to those who are struggling to make payments. This help seems angel like when you are in dire need of help. Unlike credit counselling, debt consolidation does not necessarily involves a company connected with creditors. In fact, the lenders in this case don’t really care as to how you will use this money. They are only interested in how you will repay it. These factors are also same for commercial mortgage Mississauga.

Another major difference between credit counselling and debt consolidation is that you don’t really have to possess an impressive credit score for the former, while the latter depends a lot on it. In case of a counselling, if you can’t pay the monthly payments, then a debt management plan will help you out and you shall be fine. On the other hand, for a debt consolidation, a good credit score will help you gain maximum benefits of the loan that you have acquired to pay your debts. For instance, a good credit score can help you cut a deal with the best interest rates, while a bad one can cost you a lot through high interest rates.

Ultimately, the choice you make of a debt relief option will solely depend on how much load your finances can take. You need to be sure regarding your financial standing as this is the only way to get out of the debt-zone. Once, you have done all the essential analysis, step forward to choose the debt relief plan that will suit you best. We, at CanadaMGC, are debt consolidation Mississauga experts providing effective mortgage solutions. With our strategic debt relief plans, we have benefited hundreds of people. Visit us sometime to know more about the mortgage plan you think suits you best.